Va cash out refinance bad credit

When you apply to refinance your student loans one of the first things any lender will do is perform a credit check which includes a review of your credit score. Credit scores range from 300 which is.

Infographic Va Loan Eligibility Va Loan Loan Lenders Va Mortgage Loans

Requirements for an FHA cash-out refinance are more lenient than they are for conventional cash-out refinance loans.

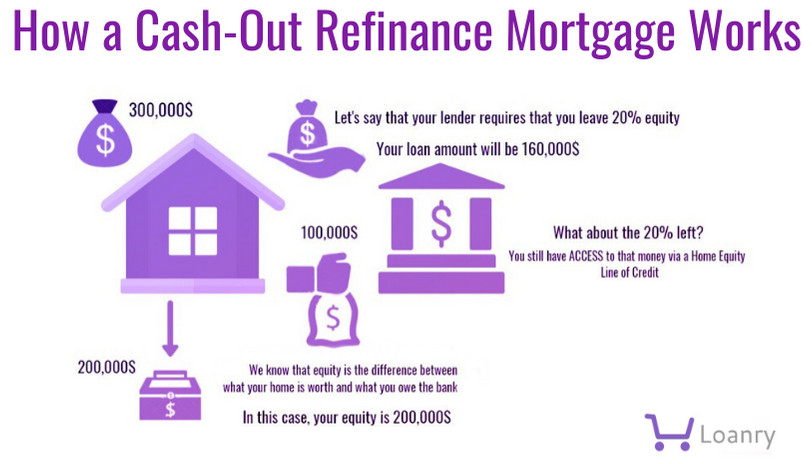

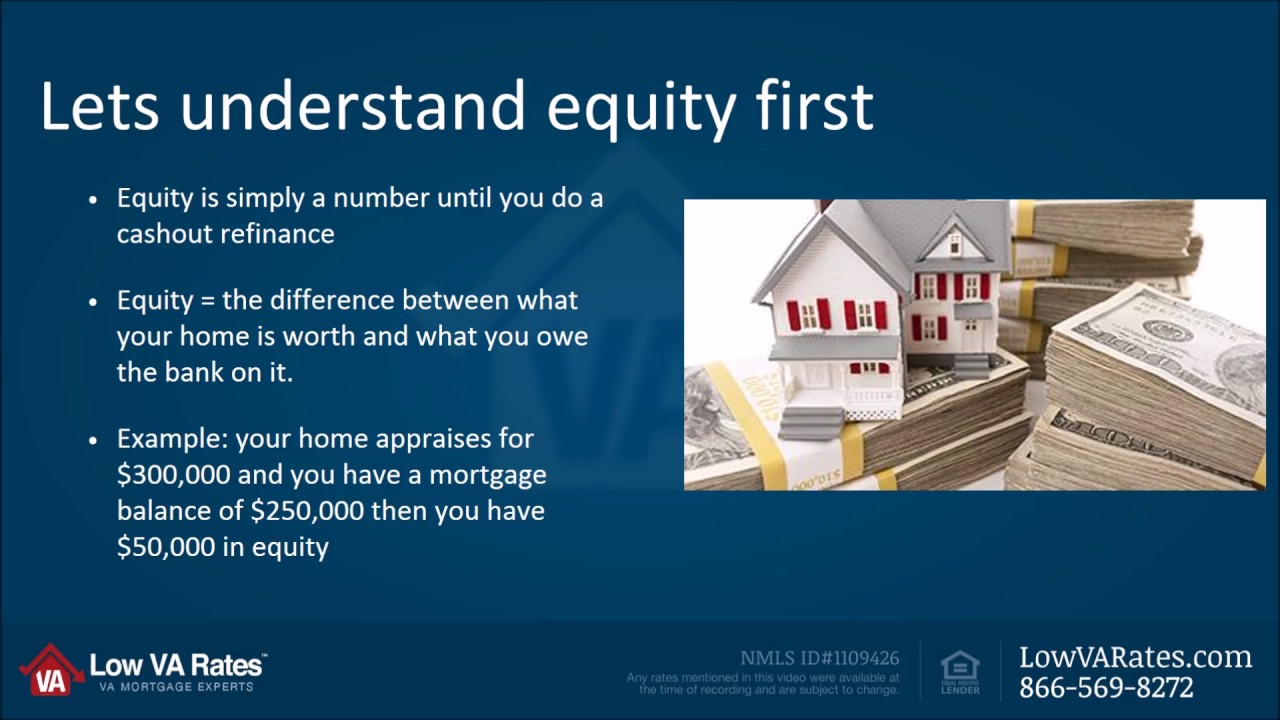

. Getting a car loan with bad credit is still possible though you need to be careful of high rates and fees. For example say your home is worth 500000 and you owe 300000 on an. In a cash-out refinance the loan size stays the same and that equity is given to you as cash to use as you like.

For example you may qualify to refinance an FHA loan with as low as a 500 credit score provided you have at least 10 home equity. Here we dive into credit requirements and how borrowers can get a VA loan with bad credit. A cash-out refinance lets you get cash from the equity youve built in your home.

When considering a VA refinance there are two options. While its more difficult to refinance a mortgage with bad credit its not impossible. VA loans are available with no down payment requirement for veterans active military and their spouses with credit scores as low as 500.

Note that FHA cash-out refinances are also limited to 80 percent of your homes value but with a VA cash-out. Furthermore vehicles must be no older than 10 years with a maximum mileage of 125000 miles. VA Loan with Bad Credit Scores 500-620.

Credit scores are generated by credit bureaus the three major bureaus are Experian Equifax and TransUnion based on data about your payment history on other loans and overall. Lenders use your credit score to determine how likely it is that you will pay them back in full and on time. A cash-out refinance differs from a traditional mortgage refinancing which simply replaces your current loan with a new loan that has a new set of terms and in many cases a lower interest rate.

Not affiliated with any government agency. Mortgage Research Center LLC NMLS 1907. Technically you can get an FHA cash-out loan with a FICO score as low as 500.

The minimum credit score is 500 with a maximum 80 LTV ratio. A simple refinance will involve paying off your original mortgage with a new loan ideally one with a much lower interest rate. A cash-out refinance also differs from a home equity line of credit HELOC which allows you to borrow cash using the home-equity as collateral.

Bad credit is OK as are dismissed or discharged bankruptcies. Todays VA Refinance. Before we dive into refinancing for bad credit lets first take a look at how your credit score impacts your refinance.

Theres no minimum credit score required for a VA refinance although many lenders require a 620 minimum. VA loans are also available for credit scores as low as 500. Youll pay FHA closing costs and FHA mortgage insurance for a cash-out refi.

No minimum but lenders typically require 620. A VA IRRRL lets you refinance the outstanding balance of a fixed-rate VA loan with the requirement that the refinance will lowers your interest rate and monthly. 5500 6117 APR with 0750 discount points on a 60-day lock period for a 15-Year VA Cash-Out refinance.

The minimum loan or refinance amount is 8000. In this scenario the second loan is smaller because youve made several payments already. The VA also guarantees cash out refinance loans for eligible persons.

It is one of the better mortgage programs available and a great benefit to our deserving veterans. Youll need to go through a credit check and underwriting and the lender may require an appraisal. To qualify you should have a minimum income of 1800 per month.

Best 0 APR Credit Cards Best Cash Back Credit Cards. An exception to this is a VA cash-out refinance which allows borrowers to access up to 100 of their homes equity. A streamline refinance or a cash-out refinance.

True to its name this program also known as the Interest Rate. However youre much more likely to find lenders starting in the 580-600 range and even some as high as 600. Minimum credit score needed.

Fixed-rate Conventional Cash-out VA VA Streamline ARM Jumbo Navy Federal NLMS 399807 has mortgage refinancing options ranging from 10- to 30-year loan terms for their VA Streamline IRRL and Homebuyers Choice.

Cash Out Refinance To Buy Out Of Your Chapter 13 Bankruptcy Youtube

Cash Out Refinance Definition

Cash Out Refinance A Beginner S Guide Money Com

Infographic Va Loan Eligibility Va Loan Va Mortgage Loans Mortgage Loan Officer

Va Cash Out Refinance How It Works And How To Get One Fox Business

Cash Out Refinance Clearance 50 Off Www Wtashows Com

Va Loan Basics Va Loan Rates Loan Rates Va Loan Mortgage Interest Rates

Pin On Maui Real Estate News Tips

Va Cash Out Refinance Loan 2022 Guidelines Information

Cash Out Refinance 500 Credit Score How To Get Approved

Benefits Of Buying A Home With A Va Mortgage Loan

What Exactly Can A Veteran Purchase With A Va Mortgage Http Activerain Com Blogsview 4236218 What Exac Va Loan Va Mortgage Loans Refinance Student Loans

Cash Out Refinance Sale Online 52 Off Www Wtashows Com

Types Of Mortgage Refinancing Programs Refinance Mortgage Refinancing Mortgage Home Refinance

Should You Consider Refinancing Call Me Today For A Free No Obligation Mortgage Consultation Or Line Of Credit Home Equity Cash Loans Online

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Va Cash Out Refinance 100 Ltv Low Va Rates For Veterans