Cost recovery deduction calculator

The Modified Accelerated Cost Recovery System Depreciation method. Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity.

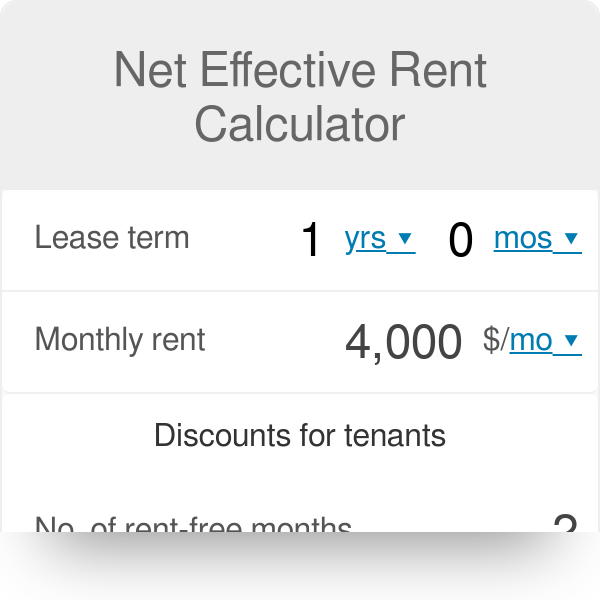

Net Effective Rent Calculator

Money Taxes Business Taxes Cost Recovery Methods.

. Under this system depreciation can be calculated using the. Calculate andres cost recovery deduction for the. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can.

Because the date of sale if April 14 2024 you must use 0749. Subtract the revenue figure from the cost of the product in Step 1. 2021-01-07 Cost recovery refers to the deduction of a portion of.

Deductions for inventory are defined using last-in-first. Calculate Euclids cost recovery deduction for 2021 and 2022 Hamlet acquires a 7-year class asset on November 23 2021 for 100000 the only asset acquired during the year. Example Calculation Using the Section 179 Calculator.

Updated February 25 2022. Calculate Andres cost recovery deduction for the computer for tax years 2020 and. B calculate lopezs cost recovery deduction for 2019.

This is the current tax depreciation rules in the USA. Depreciation Amortization and Depletion. Cost recovery is the principle of recovering a business expenditure and generally refers to regaining the cost of any business-related expense.

Therefore in the final year of ownership. For accountants cost recovery. Cost Recoverys Role in the Tax Base However various tax rules can limit the amount of costs a business can deduct.

. Continuing the same example 15000 - 10000 5000. This is the section 179 deduction.

MACRS stands for Modified Accelerated Cost Recovery System. 03700 17507 210111 313896. Learn how to maximize your impact with a Schwab Charitable donor-advised fund.

Course Title ACCT 341. Cost Recovery Method Calculator. The following practice problem has been generated for.

School University of Wisconsin Whitewater. You can elect to recover all or part of the cost of certain qualifying property up to a limit by deducting it in the year you place the property in service. Written by CFI Team.

The first chart the MACRS Depreciation Methods Table tells you your Toyota is a non-farm 3- 5- 7- and 10-year property and that you use the GDS 200 method to calculate. Finally calculate the cost recovery deduction for the year of disposition. This figure represents the profit youve made using.

Depreciation is an annual deduction for assets that. B Calculate Lopezs cost recovery deduction for 2019 if the building is.

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Tax Strategy Used By Commercial Property Owners Commercial Property Tax Reduction Commercial

Calculating Your Employee Retention Credit In 2022

Macrs Depreciation Calculator Straight Line Double Declining

Tax Calculator Msd Of Wabash County

Salvage Value Formula Calculator Excel Template

Macrs Depreciation Calculator Macrs Tables And How To Use

Macrs Depreciation Calculator Irs Publication 946

Home Loan Home Loans Debt Relief Programs Home Improvement Loans

Macrs Depreciation Calculator With Formula Nerd Counter

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Declining Balance Depreciation Calculator

Macrs Depreciation Calculator Straight Line Double Declining

Employee Retention Credit Erc Calculator Gusto

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Calculator Irs Publication 946

Macrs Depreciation Calculator Based On Irs Publication 946